Your Path to Financial Freedom: A Deep Dive into Debt Consolidation Companies

Debt can feel like a heavy cloak, weighing down every aspect of your life. The juggling act of multiple monthly payments, the endless stream of interest charges, and the constant stress can be overwhelming. For many, the idea of a single, manageable payment is a powerful beacon of hope. This is where debt consolidation companies come in, offering a potential lifeline to a more organized and less stressful financial future.

But what exactly are these companies, and how do they work? Are they a magic bullet, or are there hidden pitfalls to be aware of? In this comprehensive guide, we will explore the world of debt consolidation companies, helping you understand their services, navigate your options, and make an informed decision on your journey to financial freedom.

What is Debt Consolidation?

At its core, debt consolidation is the process of combining multiple debts into a single, new debt. The goal is to simplify your finances by having one monthly payment to a single lender, often at a lower interest rate than your original debts. This new loan is typically used to pay off high-interest debts like credit cards, medical bills, or personal loans.

Think of it like this: instead of sending checks to three or four different credit card companies, you take out one new loan, pay off all those credit cards, and then only have to worry about one monthly payment to the new lender. The key benefits are:

- Simplified Payments: You have one bill to track and pay each month, making budgeting and organization much easier.

- Potential for Lower Interest Rates: If you have good credit, you may qualify for a new loan with a lower interest rate than the average of your existing debts, saving you a significant amount of money over time.

- Clear Path to Debt-Free Living: A debt consolidation loan has a fixed repayment schedule, meaning you know exactly when your debt will be paid off. This provides a clear end date and a powerful motivator.

Debt Consolidation vs. Debt Management: A Crucial Distinction

Before we delve into the companies, it’s vital to understand that “debt consolidation company” can be a broad term. There’s a critical difference between a company that offers debt consolidation loans and a credit counseling agency that offers a debt management plan (DMP).

- Debt Consolidation Loans: This is a financial product. You are taking on new credit (a loan or a new credit card) to pay off your old debts. This requires you to have a decent credit score to qualify for a favorable interest rate. The company is a lender, and you are their borrower.

- Debt Management Plans (DMPs): This is a structured repayment program, not a new loan. A non-profit credit counseling agency negotiates with your creditors on your behalf to reduce interest rates and fees. You then make one single monthly payment to the agency, which distributes the funds to your creditors. DMPs are often a better fit for those with poor credit who can’t qualify for a low-interest consolidation loan.

For the purpose of this post, we will primarily focus on companies that provide debt consolidation loans, but it’s important to remember that DMPs and other alternatives exist and may be a better solution depending on your specific situation.

Finding the Right Debt Consolidation Company: Key Factors to Consider

The market is filled with lenders and companies promising to solve your debt problems. So, how do you find a legitimate and effective partner on your financial journey? Here are the key factors to evaluate:

1. Interest Rates and Fees: The primary reason to consolidate is to save money on interest. Be a smart consumer and compare Annual Percentage Rates (APRs) from different lenders. Look for transparent fee structures. Some lenders charge an “origination fee,” a percentage of the loan amount, which is taken out of your loan before you even receive the funds. Others might have prepayment penalties. Always ask for a breakdown of all costs. A lower interest rate with a high origination fee might not be the best deal.

2. Loan Requirements: Each company has different criteria for approval. Common requirements include:

- Credit Score: This is a significant factor. Lenders often have a minimum credit score requirement. Generally, the higher your score, the better your chances of getting a low interest rate. Don’t be discouraged if you have a lower score, as some lenders specialize in working with a range of credit profiles.

- Debt-to-Income Ratio (DTI): This is the percentage of your gross monthly income that goes toward paying your monthly debt payments. Lenders use this to gauge your ability to take on and repay a new loan.

- Income and Employment History: Lenders want to ensure you have a stable source of income to make your monthly payments.

3. Reputation and Accreditation: Do your homework. Look up the company on the Better Business Bureau (BBB) website and read customer reviews on independent sites like Trustpilot. Be wary of companies with a history of complaints or aggressive sales tactics. Look for accreditations from reputable organizations like the American Fair Credit Council (AFCC) or the American Association for Debt Resolution (AADR).

4. Customer Service and Support: A good debt consolidation company will offer more than just a loan. They should provide excellent customer service and be available to answer your questions throughout the process. Some companies offer additional financial education resources, which can be invaluable in preventing future debt problems.

5. Funding Speed: If you need to pay off your debts quickly, consider a lender that offers fast funding. Many online lenders can provide an instant decision and have the funds deposited into your bank account within a few business days.

Top Debt Consolidation Companies to Consider

While a definitive “best” company doesn’t exist for everyone, certain lenders consistently rank highly due to their competitive rates, transparent practices, and strong customer service. Here’s a look at some of the leaders in the space, keeping in mind that their offerings and terms can change:

- SoFi: Known for its low rates and large loan amounts, SoFi is an excellent option for borrowers with good to excellent credit. They also offer a wide range of financial products and member perks.

- LightStream: An online lending division of Truist, LightStream is another top choice for those with stellar credit. They offer a “Rate Beat” program and highly competitive rates.

- Discover: A well-known name in the financial world, Discover offers personal loans specifically for debt consolidation. They can make direct payments to your creditors, simplifying the process even further.

- Happy Money: Formerly known as Payoff, Happy Money focuses specifically on consolidating credit card debt. They partner with credit unions and community-centered financial institutions to provide loans.

- Upstart: This company uses a unique underwriting model that goes beyond just your credit score, considering factors like your education and job history. This can be a good option for those with limited credit history.

- National Debt Relief: While they primarily focus on debt settlement, they are often a good starting point for a free consultation. They can help you explore all your options, including a debt consolidation loan if that’s the best fit.

The Pros and Cons of Debt Consolidation

Even with the right company, debt consolidation is not a one-size-fits-all solution. It’s crucial to weigh the benefits against the potential risks.

The Pros:

- Clarity and Simplicity: Instead of a complex web of different payments, you have one clear, predictable bill.

- Lower Overall Cost: A lower interest rate can save you thousands of dollars over the life of the loan.

- Improved Credit Score: By paying off revolving credit card debt, you can lower your credit utilization ratio, which is a major factor in your credit score. Consistent, on-time payments on your new loan will also help build a positive credit history.

The Cons:

- Risk of More Debt: Consolidating your debts and freeing up your old credit card lines can be a temptation to overspend and fall back into a cycle of debt. If you don’t address the underlying spending habits that led you into debt in the first place, you could end up worse off than before.

- Longer Repayment Period: While a debt consolidation loan may have lower monthly payments, it might also have a longer repayment term. This could mean you pay more in total interest over time, even if the interest rate is lower.

- Not a Guaranteed Solution: You might not be able to get a low-interest rate loan if you have a poor credit score. In this case, other options like a debt management plan or even bankruptcy might be more appropriate.

- Hidden Fees: As mentioned, watch out for origination fees, application fees, or prepayment penalties that can offset your savings.

The First Step: Is Debt Consolidation Right for You?

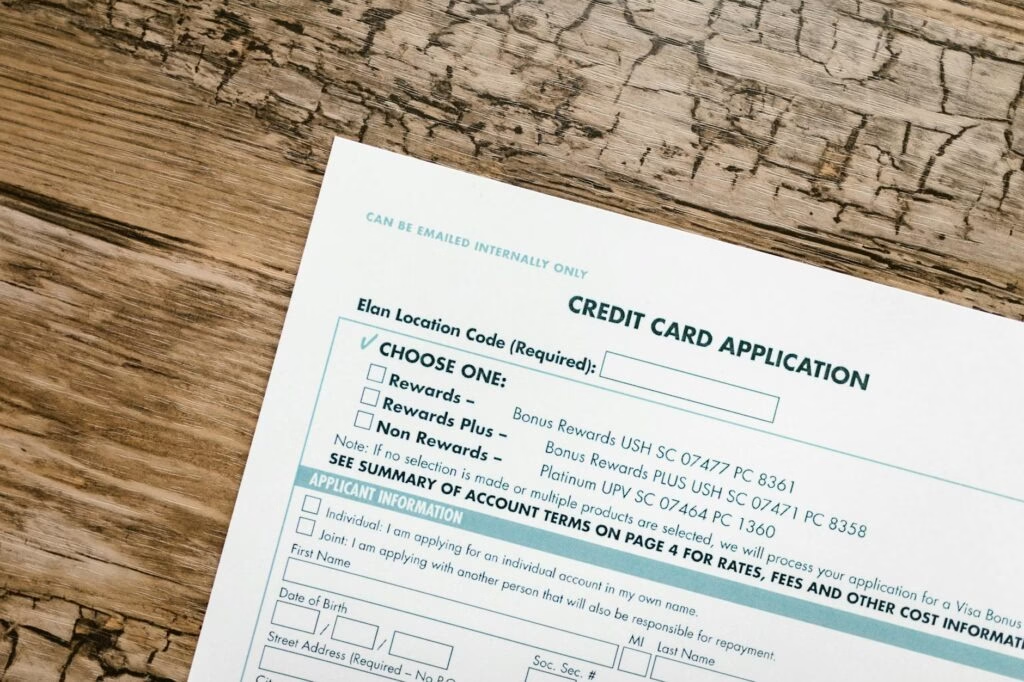

Before you start filling out applications, take a step back and get an honest look at your financial situation.

- Calculate Your Total Debt: Add up all your unsecured debts, including credit cards, personal loans, and medical bills.

- Analyze Your Spending Habits: Why did you get into debt in the first place? If it was due to a temporary crisis, a consolidation loan could be a great tool. If it’s a symptom of a deeper issue with overspending, you need to address the root cause first.

- Check Your Credit Score: Get your credit score from one of the major bureaus (Experian, Equifax, or TransUnion) or through a service like Credit Karma. This will give you an idea of what kind of loan terms you might qualify for.

- Compare All Your Options: Don’t just look at debt consolidation loans. Research debt management plans, the debt snowball or avalanche methods, and other alternatives to see which one aligns best with your financial goals and current situation.

Conclusion

Debt consolidation companies can be a powerful and effective tool for simplifying your finances and taking control of your debt. By replacing multiple high-interest debts with a single, manageable loan, you can gain clarity, save money, and create a clear path to becoming debt-free.

However, it is not a decision to be taken lightly. The key to success is to be a well-informed consumer. Do your research, compare rates and fees, understand the pros and cons, and choose a reputable company that offers a transparent process and excellent support. With careful planning and a commitment to new financial habits, a debt consolidation loan can be the catalyst that transforms your financial stress into financial freedom.