Fixed vs. Variable Loan Rates: Which One Wins in a Shaky Economy?

In today’s volatile global economy—rattled by inflation surges, interest rate hikes, and geopolitical tensions—borrowers face an increasingly difficult question: should you lock in a fixed loan rate or take your chances with a variable one? The answer isn’t as clear-cut as it once was. As central banks tighten and loosen monetary policies at breakneck speed, the choice between fixed and variable rates can mean thousands in savings or losses.

In this blog, we’ll break down both loan types, analyze how each performs in economic uncertainty, and help you decide which strategy may protect your wallet when the market feels like a roller coaster.

Understanding the Basics

Before we pit them against each other, let’s define what we’re talking about.

Fixed Loan Rate:

A fixed-rate loan charges the same interest rate for the entire term of the loan. Whether you’re borrowing for 5, 15, or 30 years, your monthly payment remains the same—no matter what happens to the broader economy.

Pros:

- Predictable payments

- Protection from rising interest rates

- Easier long-term budgeting

Cons:

- Typically higher starting rate

- No benefit if market rates drop

Variable (or Adjustable) Loan Rate:

A variable-rate loan has an interest rate that can fluctuate over time. It’s often tied to an index (like the prime rate or LIBOR). Your rate adjusts periodically—monthly, quarterly, or annually—based on market conditions.

Pros:

- Lower initial rates

- Potential savings in a falling-rate environment

Cons:

- Unpredictable monthly payments

- Risk of rising interest costs

- Stress from uncertainty

Economic Instability: The Game-Changer

In a stable economy, variable-rate loans may feel less threatening. But what happens when inflation skyrockets, central banks slam the brakes with rate hikes, or recessions loom?

This is where the decision becomes far more strategic. Let’s walk through three economic scenarios and see which loan type holds up best.

Scenario 1: High Inflation & Central Bank Tightening

This was the global reality in 2022–2023, and many economies are still feeling its aftershocks.

What Happens:

- Central banks raise interest rates aggressively.

- Variable loan rates climb quickly.

- Borrowers with variable rates see monthly payments surge.

Winner: Fixed Rate

Fixed-rate borrowers lock in their rates and are shielded from sudden spikes. Variable-rate borrowers often face payment shock as their rates reset higher, sometimes multiple times a year.

Takeaway: In a high-inflation economy, fixed loans provide valuable peace of mind and financial predictability.

Scenario 2: Recession or Slowdown

In a recession, demand shrinks, unemployment rises, and central banks often cut interest rates to stimulate spending.

What Happens:

- Interest rates fall.

- Variable-rate borrowers see their payments decrease.

- Fixed-rate borrowers miss out on lower rates.

Winner: Variable Rate

Borrowers with adjustable rates benefit as their rates decline, reducing monthly payments and overall interest cost.

Takeaway: In a weakening economy, variable loans can be a financial advantage—but only if the recession is severe or prolonged.

Scenario 3: Volatile or Mixed Economy

Sometimes the economy doesn’t follow a clear path. Inflation may rise and fall in waves. Central banks may hike, pause, or cut rates unpredictably.

What Happens:

- Interest rates move up and down frequently.

- Variable loan rates become unpredictable.

- Fixed-rate borrowers remain unaffected.

Winner: Fixed Rate (Usually)

While there may be brief moments when variable rates are advantageous, the unpredictability of this environment favors fixed rates. Borrowers don’t want to play interest-rate roulette during economic uncertainty.

Takeaway: If the future is unclear (as it often is), locking in stability may be the smarter long-term play.

Beyond the Numbers: The Psychological Factor

While interest rates and payment schedules are important, peace of mind plays a major role in borrower satisfaction.

Variable-rate loans introduce anxiety—especially in uncertain times. Watching the news, tracking Fed announcements, and worrying about rate resets can be mentally taxing. Fixed-rate borrowers, meanwhile, can ignore economic chaos, knowing their payments won’t change.

Mental Health Edge: Fixed-rate loans win for borrowers who value financial clarity and emotional stability.

When Variable Might Still Make Sense

Despite the risks, variable loans can still be a strategic tool—if you know how to use them wisely.

Ideal Situations for Variable Rates:

- Short-Term Ownership: If you plan to sell or refinance in a few years, you may benefit from the lower initial rate without facing the long-term risk of rate hikes.

- Rate Caps in Place: Some variable loans come with caps that limit how much your rate can increase. Understand these details before committing.

- Confidence in Falling Rates: If you believe (with solid reason) that interest rates will decline significantly in the near term, a variable loan may pay off.

Pro Tip:

Look for hybrid adjustable-rate mortgages (ARMs) that offer a fixed rate for the first 3, 5, or 7 years before adjusting. This gives you short-term stability with longer-term flexibility.

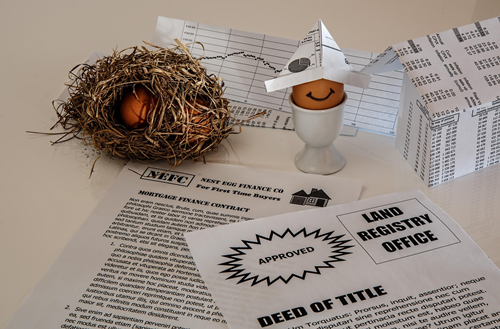

Who Should Choose Fixed Loans in a Shaky Economy?

- First-time homebuyers

- Borrowers with tight budgets

- Risk-averse individuals

- Anyone planning to stay in their home or loan long-term

- People who can’t tolerate payment fluctuation

Who Can Consider Variable Loans?

- Short-term investors or home flippers

- High-income earners with financial flexibility

- Borrowers planning to refinance soon

- Those confident in a rate decline within 1–3 years

- People who understand the risk and have backup funds

Bonus: What the 2025 Rate Landscape Suggests

As of mid-2025, economists are divided. Some predict more rate cuts as inflation cools. Others warn of second-wave inflation and potential rate hikes due to global supply shocks and labor shortages.

In this kind of uncertain landscape, the scales are slightly tilted toward fixed-rate loans—not because variable is inherently bad, but because risk management becomes crucial when forecasts are cloudy.

Final Verdict: Which One Wins in a Shaky Economy?

There’s no one-size-fits-all answer, but based on history, psychology, and economic models:

Fixed-rate loans usually win in unstable or shaky economies.

They offer certainty in a world that offers very little of it. Variable loans may outperform in certain short-term scenarios, but the risks can be significant—especially if rate hikes catch you off guard.

Your Next Steps: Making the Smart Choice

Here’s how to decide between fixed and variable for your situation:

- Review Your Timeline: Are you in this loan for 3 years or 30?

- Check the Spread: How much lower is the variable rate right now? Is it worth the gamble?

- Understand Your Risk Tolerance: Could you handle a payment jump if rates rise?

- Model Different Scenarios: Use online loan calculators to simulate best-case and worst-case outcomes.

- Talk to a Loan Advisor: Get a professional to help you weigh options tailored to your income, goals, and location.

Conclusion

In a shaky economy, protecting your finances should be priority number one. While variable-rate loans have their perks, the predictability, protection, and peace of mind of fixed-rate loans often prove more valuable when economic winds shift.

Remember: the “cheapest” loan isn’t always the best one—especially when uncertainty is the only guarantee. Choose the loan that lets you sleep at night, not the one that keeps you glued to interest rate headlines.