Navigating the Maze: Fixed vs. Variable Loan Rates in a Shaky Economy

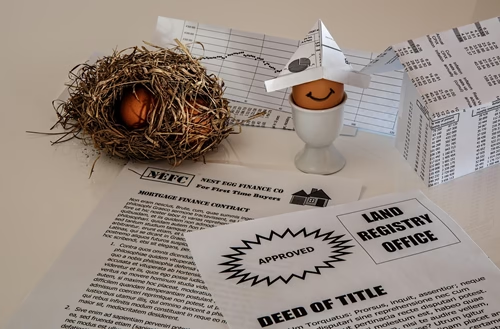

The global economy feels a bit like a rollercoaster right now, doesn’t it? 🎢 One minute, things seem to be heading up, and the next, we’re bracing for another dip. This volatility trickles down into every aspect of our financial lives, especially when we’re considering taking on significant debt like a mortgage, a car loan, or a business loan. The single biggest decision you’ll face in this process is choosing between a fixed or a variable interest rate.

This isn’t just financial jargon; it’s a choice that can impact your monthly budget, your stress levels, and your long-term financial health for years, or even decades. In a stable economy, the decision might be simpler. But when things are shaky, the stakes are much higher. Get it right, and you could save thousands and sleep soundly at night. Get it wrong, and you might face a future of financial anxiety and ballooning payments.

So, how do you make the right call? Which loan type truly wins when the economic forecast is cloudy? This guide will break down everything you need to know to navigate this critical decision with confidence.

Understanding the Basics: The Two Sides of the Coin

Before we can declare a winner, it’s essential to understand the fundamental mechanics of each loan type. Think of it as choosing your vehicle for a long road trip where the weather is unpredictable.

The Fixed-Rate Loan: Your Reliable Sedan 🚗

A fixed-rate loan is exactly what it sounds like: the interest rate is locked in for the entire duration of the loan. Whether you have a 30-year mortgage or a 5-year car loan, your interest rate today will be the same interest rate on your very last payment.

- How it works: The lender offers you a specific interest rate, say 6.5%, based on your creditworthiness and current market conditions. If you accept, that 6.5% rate is set in stone. Your principal and interest payment will be the exact same amount every single month.

- The Analogy: It’s like buying a brand-new, reliable sedan for your road trip. You know exactly how much fuel it consumes per mile, and the car payment is a predictable monthly expense. There are no surprises. You can plan your entire trip’s budget around this known cost, regardless of whether you hit a surprise snowstorm or a beautiful sunny patch.

- Best for: Budget-conscious individuals, first-time homebuyers, and anyone who values predictability and stability over potential savings.

The Variable-Rate Loan: The High-Performance Convertible 🏎️

A variable-rate loan, often called an adjustable-rate mortgage (ARM) in the housing world, is a bit more of a wild card. The interest rate can change over time, moving up or down based on a specific benchmark index.

- How it works: This loan is tied to a financial index, like the Secured Overnight Financing Rate (SOFR). The lender adds a margin to this index to determine your rate. For example, your rate might be “SOFR + 2.5%.” If the SOFR index goes up, your interest rate goes up, and so does your monthly payment. If it goes down, you could save money. These loans often come with an initial “teaser” period where the rate is fixed for a short time (e.g., 5 years on a 5/1 ARM) before it starts adjusting.

- The Analogy: This is the high-performance convertible. When the weather is perfect, you can put the top down and enjoy an exhilarating, fuel-efficient ride (a low initial rate). But if a hailstorm hits (interest rates spike), you’re exposed. Your journey might suddenly become much more expensive and stressful as you scramble to deal with the changing conditions.

- Best for: Borrowers who don’t plan to keep the loan long-term, those with a high-risk tolerance, or individuals who expect their income to increase significantly.

The Case for Fixed-Rate Loans: Your Fortress in the Storm

In a shaky economic climate, characterized by high inflation and uncertainty, the fixed-rate loan emerges as the clear champion for most people. Its primary superpower is predictability.

Unshakeable Stability for Budgeting

When inflation is high, the cost of everything from groceries to gas is already squeezing your budget. The last thing you need is for your largest monthly expense—your mortgage or loan payment—to suddenly jump. A fixed rate eliminates this risk entirely. You know exactly what you’ll owe every month, for the life of the loan. This makes budgeting simple and allows you to plan your finances with a high degree of certainty, which is invaluable when other costs are fluctuating.

Imagine you take out a $300,000 mortgage at a fixed rate of 6%. Your principal and interest payment would be approximately $1,798.65 every month for 30 years. Whether the central bank raises interest rates to 10% or drops them to 2%, your payment remains $1,798.65. This stability is the bedrock of financial security.

A Hedge Against Rate Hikes

A “shaky economy” is often code for an economy where the central bank (like the Federal Reserve in the U.S.) is actively raising its benchmark interest rates to combat inflation. This is the primary danger for anyone with a variable-rate loan. Each time the central bank announces a rate hike, variable-rate borrowers see their future payments tick upward.

By locking in a fixed rate, you are essentially making a bet that rates will be higher in the future. If you secure a rate today and the market rates double over the next two years, you’ve protected yourself from a massive increase in your borrowing costs. You’re effectively building a fortress around your finances that is immune to the central bank’s inflation-fighting policies.

The Psychology of Peace of Mind 🧘

Never underestimate the emotional toll of financial uncertainty. Waking up and worrying about whether the latest economic news will make your mortgage payment unaffordable is a significant source of stress. A fixed-rate loan offers peace of mind. You can set it and forget it, confident that your payment won’t change. This mental and emotional stability is a powerful, though often overlooked, benefit, particularly when the news is filled with dire economic predictions.

The Argument for Variable-Rate Loans: A Calculated Risk

While a fixed-rate loan is the safer bet, it would be a mistake to dismiss variable rates entirely. For the right person in the right situation, they can still be a strategic choice, even in a wobbly economy.

The Allure of the Low Initial Rate

The most significant advantage of a variable-rate loan is the lower introductory interest rate. Lenders offer this “teaser” rate to attract borrowers. This can be a huge benefit for short-term cash flow. For example, if the fixed rate is 7%, a 5/1 ARM might offer an initial rate of 5.5%. On a $300,000 loan, that’s a difference of over $270 per month for the first five years. That extra cash could be used to build an emergency fund, invest, or cover other rising costs.

When Might Rates Go Down?

While a shaky economy often means rising rates, it can also precede a recession. If an economy tips into a significant downturn, central banks often reverse course and begin slashing interest rates to stimulate growth. If you’re in a variable-rate loan and this happens, you’ll be the one celebrating. Your interest rate will fall along with the benchmark, and your monthly payments will decrease, providing financial relief just when you might need it most. This is the gamble a variable-rate borrower takes: that the economic storm will lead to lower, not higher, rates in the medium to long term.

Understanding Your Protections: Rate Caps

Variable-rate loans aren’t the complete Wild West. They come with built-in protections called caps.

- Periodic Adjustment Cap: This limits how much your rate can increase at each adjustment period (e.g., once per year).

- Lifetime Cap: This limits the total amount your interest rate can increase over the entire life of the loan.

For example, a loan might have caps of “2/6,” meaning the rate can’t increase by more than 2% in any given year and no more than 6% over the loan’s lifetime. These caps provide a ceiling, ensuring your payments don’t spiral into infinity. However, even with caps, the maximum potential payment can still be substantially higher than your starting payment.

Key Factors to Consider in Your Decision

The winning choice isn’t universal; it’s deeply personal. It depends less on what the economy is doing and more on your specific circumstances. Ask yourself these critical questions:

1. How Long Will You Keep the Loan?

This is perhaps the most important factor. If you’re buying a “starter home” that you plan to sell in 3-5 years, a variable rate (like a 5/1 ARM) can be a brilliant move. You can take advantage of the low initial rate for the entire time you own the property and sell it before the rate has a chance to adjust upwards. However, if you’re buying your “forever home,” a fixed rate’s long-term stability is almost always the better option.

2. What is Your Personal Risk Tolerance?

Be honest with yourself. Do you enjoy taking risks for a potential reward, or does uncertainty keep you up at night? If you’re someone who constantly checks the stock market and feels a knot in your stomach when it drops, a variable-rate loan is likely not for you. The peace of mind from a fixed rate will be worth far more than any potential savings. If you’re a spreadsheet wizard with a solid financial cushion who is comfortable with a bit of a gamble, a variable rate might be on the table.

3. How Secure is Your Financial Situation?

Can your monthly budget absorb a significant payment increase? If you’re already stretching to make the payments at the initial variable rate, you’re setting yourself up for disaster. A good rule of thumb is to calculate what your payment would be if the rate hit its lifetime cap. If that number would cause you serious financial distress, you should steer clear of a variable rate. If your income is stable and expected to grow, you might have the flexibility to handle potential increases.

The Verdict: And the Winner Is…

In a shaky, unpredictable, and inflationary economy, the fixed-rate loan is the undisputed champion for the vast majority of borrowers. 🏆

It provides a shield of certainty in a world of variables. It allows you to budget effectively, protects you from the very real threat of rising interest rates, and delivers invaluable peace of mind. It turns your biggest expense into your most predictable one.

A variable-rate loan is a tool best used by a specific type of borrower: someone with a short time horizon, a high-risk tolerance, and a rock-solid financial backup plan. For everyone else looking for security and a good night’s sleep, locking in a predictable payment for the long haul is the wisest financial move you can make.

Before you sign on the dotted line, run the numbers, assess your personal situation with brutal honesty, and consider consulting with a trusted financial advisor. Your future self will thank you for making a calm, informed decision today.